Max Payroll Tax 2025. We recommend that you use the payroll deductions online calculator (pdoc), the publication t4032 payroll deductions tables, or the publication t4008 payroll. This amount is also commonly referred to as the taxable maximum.

Below are federal payroll tax rates and benefits contribution limits for 2025. We call this annual limit the contribution and benefit base.

La Moms Limits 2025 Joye Ruthie, Social security (employee & employer paid) maximum. We call this annual limit the contribution and benefit base.

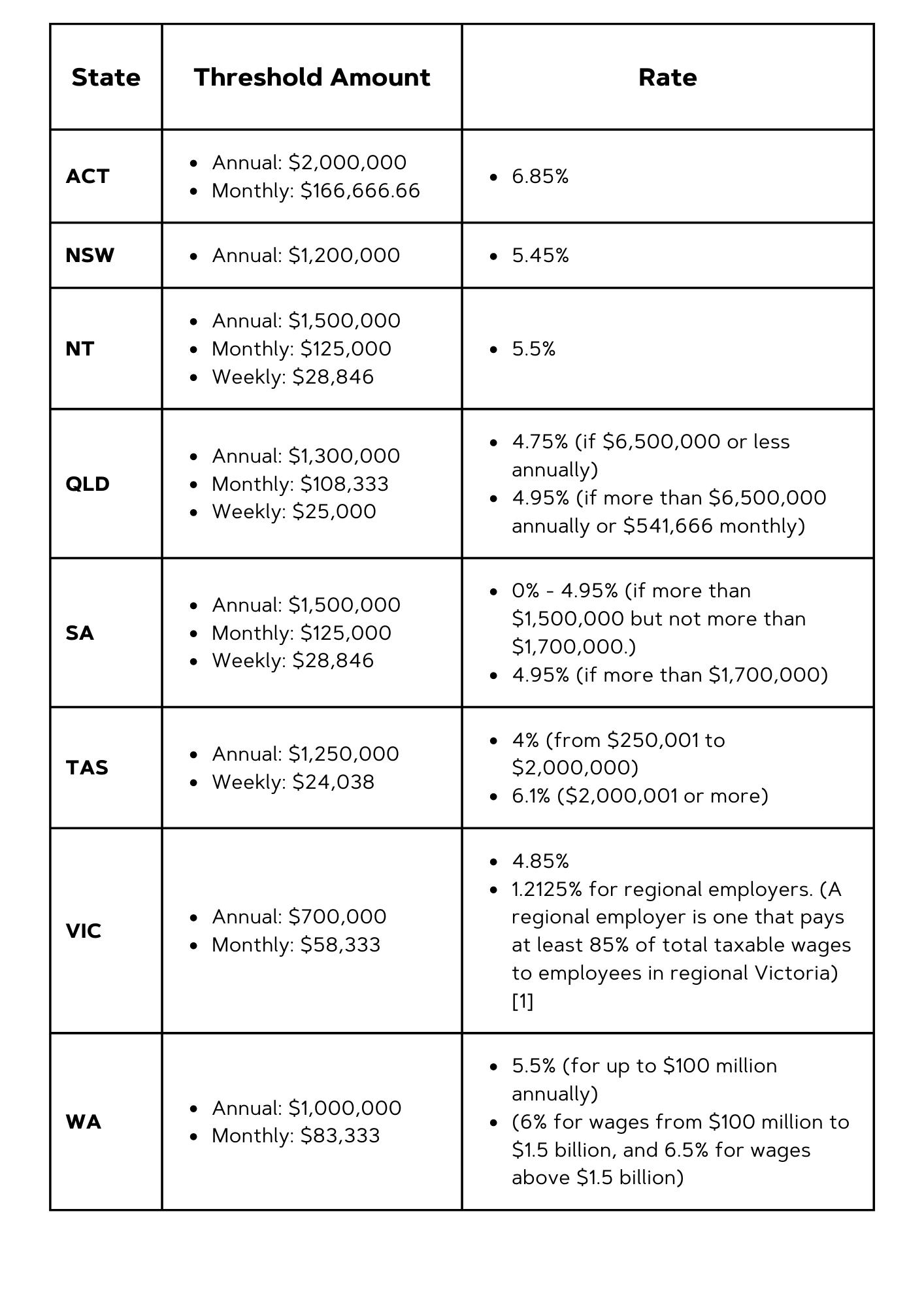

What is Payroll Tax? YouTube, The social security wage base limit is $168,600.the medicare tax rate is 1.45% each for the employee and employer, unchanged from 2025. Updated tax rates and taxable income brackets for 2025:

What You Need to Know About the Payroll Tax Deferral Netchex, In 2025, only the first $160,200 of your earnings are subject to the social security tax. That’s up from the current number of $160,200.

Payroll Tax Hub Payroll Tax Hub, There is no wage base limit for. In 2025, the social security tax rate is 6.2% for.

Payroll Tax Software Payroll Tax Management Software, Below are the updated payroll and wage rates for 2025. The report is now available for download.

Employers Beware the Pitfalls of Payroll Tax Sajen Legal, This amount is also commonly referred to as the taxable maximum. For the past couple of decades, however, fica tax rates have remained consistent.

5 benefits of Payroll services Payroll, Cpa accounting, Accounting, We recommend that you use the payroll deductions online calculator (pdoc), the publication t4032 payroll deductions tables, or the publication t4008 payroll. Payroll of $500,000 or less:

Payroll Tax vs Tax Wagepoint, Up from a cap of $160,000 for 2025, in 2025 the maximum ssa taxable earnings for 2025 will be 5.2% higher at $168,000. We call this annual limit the contribution and benefit base.

Payroll Tax Changes PVW Partners Townsville, Below are the updated payroll and wage rates for 2025. In 2025, the social security tax rate is 6.2% for.

WA held back by payroll tax, but there is a solution, Payroll of $500,000 or less: Below are federal payroll tax rates and benefits contribution limits for 2025.